12 Aug 2020

Updated on January 3rd, 2023

How To Raise Money For Your Mobile App Startup?

Ankit Singh

The mere thought of having your successful startup gives you goosebumps. It can be a life-changing experience, where your unique app concept will thrive in different stores. But where is the money?

Oops, that is the million-dollar question that keeps banging in your mind. It is disheartening for the startups, as many out there never get to see the ray of light despite having a unique concept behind them. This happens largely due to the absence of funding.

Ahh, that’s the most painful factor; to raise capital for your app. How you do that? How do you raise money to fund an app?

Well, there are many more questions, but Fret not, with this post, we’ve tried to bring you a guide to fund your mobile app, and turn your app idea into a reality. Let’s dig deeper and bring you a closer look at funding and what all it takes to secure one…

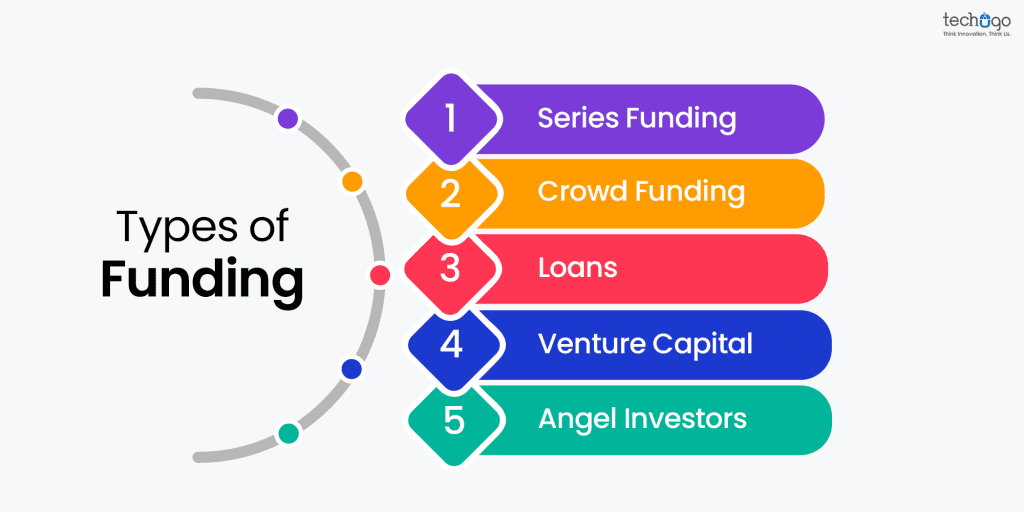

Five most common types of Funding

Now when you decided to proceed ahead with the app funding process, but you must have a clear picture of expected aspects that would come along with. And one of the most significant parts is the funding type.

Yeah, when it comes to types of startup funding, there are a lot of options to consider. Let’s check it out ahead…

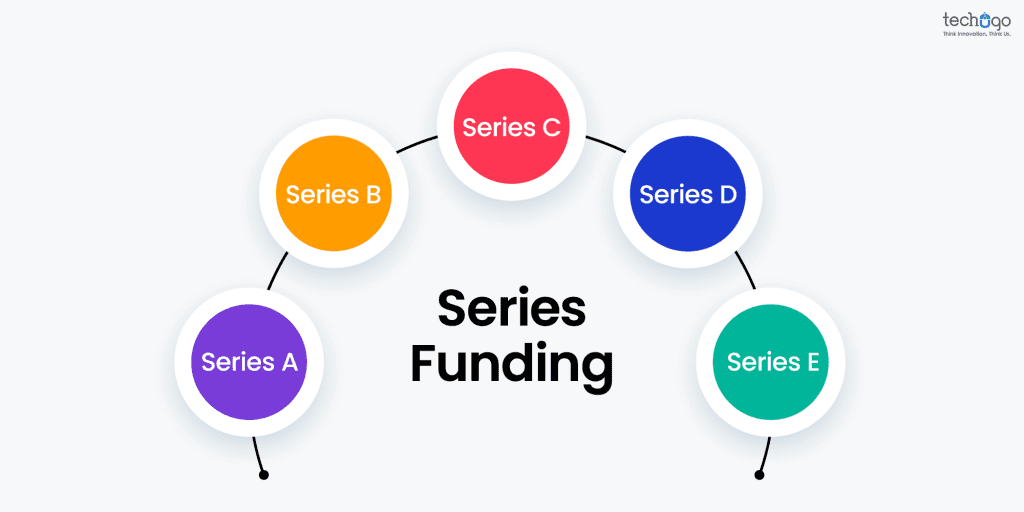

1. Series funding

This type of funding is when a startup raises rounds of funds, and in this round, each one is higher in value of the business. It is categorized in alphabetical order; Series A, B, C, D, and E.

Series A- It happens when a startup initiates from the seed stage and grab some sort of traction, which can be in the form of users, revenue, views, or any KPI. The typical range of Series A is between $10 million to $15 million. And it usually comes from the venture capital firms, however, in some angel investors also be included.

Series B– It takes place when a startup has already expanded its product and services. This series usually captures between $7 million and $10 million. And also bring the valuation to companies between $30 million and $60 million. It is driven by venture capital firms or similar investors who led the previous round.

Series C– Once a startup or a company is ready to acquire a new market and develop new products, Series C funding happens. This series brings an average of $26 million and the valuation of Series C companies is between $100 million and $120 million. It is driven by venture capital firms, willing to invest in late-stage startups, private equity firms, and banks.

Series D– Although, companies stop raising funding rounds after Series C, but still few companies choose to proceed ahead if they have not got the expected raise and are willing to increase their value before going public. It comes into existence through venture capital firms. And the amount raised differs as per the expectations of startups.

Series E– Surprisingly, few companies prefer to step ahead and make it to Series E. And the reasons are similar to raise just as Series D.

2. Crowdfunding

This is the proven method to raise capital via collective efforts of family, friends, customers, and investors. In this process, different individuals come together to raise funds. With the help of crowdfunding, entrepreneurs get an opportunity to bring their business in front of more interested parties and raise funds.

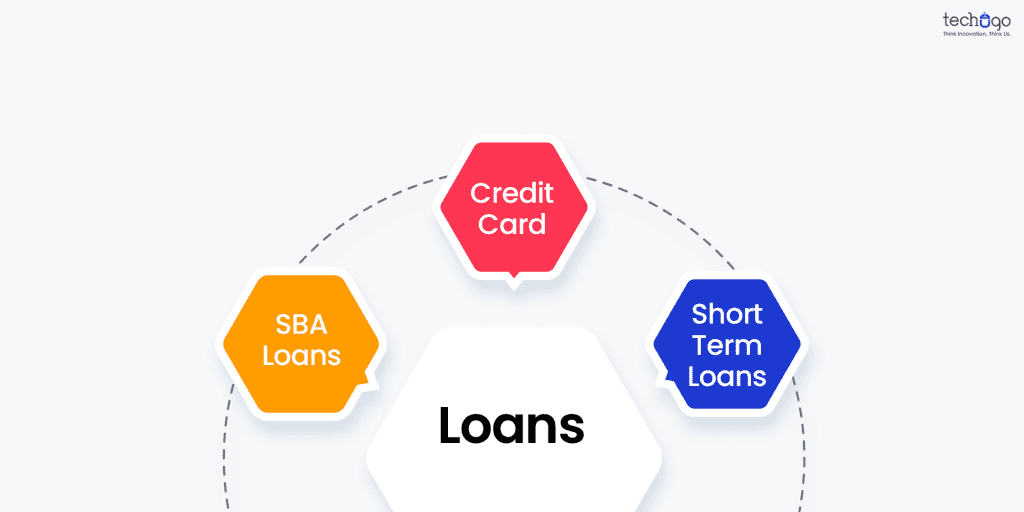

3. Loans

A startup loan indeed is a great way to help businesses to establish their foothold. For entrepreneurs willing to improve their young company or looking forward to getting other financing options it is the best choice. On the flip side, you must know that a small business startup loan basically stands for an umbrella term, and there are multiple types of financing available. Such as:

4. Venture Capital

This type of funding is the investment in startups and small businesses that are usually high risk but have the potential to experience growth. This type of investment offers a very higher ROI, which is usually in the form of an acquisition of a startup or an IPO.

For a startup to grow exponentially this option is a great choice and is run by a group of partners, who raises the large sum of money from a group of limited partners (LPs) and invests on its behalf.

5. Angel Investors

These investors have high net worth and are looking forward to investing small amounts into startups. They can make their investment without any interference from any other stakeholder.

They prefer to make investments to make a healthy return on their investment.

On the other hand, when it comes to thinking of the limit of a single angel investor to invest, then there is no as such thing. And it can cap out to any numerical figure.

Now, when you have decided to come forward with funding, the next big thing comes there, is that how should you cover everything to gain that FUNDING.

Don’t lose patience, much more is described in the post further, so just read ahead…

Create a Presentation

You need to jot down your pitch deck succinctly! Gone are the days, when investors had ample time to listen to your saga. If you really want to win the race, then you need to keep the investor deck as succinct as possible. The ideal number of slides is 6 within 10 minutes (maybe am generous to mention this time, but it is usually 6 slides= 6 minutes). Show more stats than content, they are not looking for the features but the benefits they would get if they invest in your project. Bring real-time market analysis, and how your app will make a difference.

Yes, here you have to be very particular with your approach and need to portray the business vision and value proposition of your concept, and must reflect it well in your presentation.

Explain problem & solution

There has to be a well-defined concept of the problem, and how your app concept is eventually going to bring a solution out of it. However, you must not forget that there has to enough stats and figures to support your problem and solution.

Showcase target market &opportunity

Define the target market and the opportunity it has got, so your investors can see the potential in the concept, and this will further help them understand your interests towards the concept. Further, you need to give a closer and practical approach of the competitors, who are already there, and if they have similar concepts, and how you can provide better offerings than them.

Mention revenue model

The way your app is going to monetize decides its success and encourages investors to take part in it. You need to finalize the or business model, which comes with its all pros and cons to provide the real-picture to your investors, and further shows how far you have done the research and are serious about your concept to be turned into a reality.

Show traction and validation roadmap

An app concept would remain a concept until and unless it faces the real technical ground filled with possibilities. You need to create a roadmap, how everything will happen, and what all strategies and members you need to make happen truly. Further, the concept validation must be taken into consideration to see its success valuation from the users’ point of view as well.

Share the competitive landscape

To make a notable recognition in the market, your concept must have some USP to attract consumers and select you over existing competitors dealing in the same niche.

Henceforth, you need to study and research the competitive landscape of your app’s market. Find out what other apps are offering, and ensure your offered features and functionalities are not clashing with other company’s offerings.

Your app concept has to be unique and innovative, and this is what you have to convince your investors as well. Further, you need to explain how this app is going to solve so and so issue? And how it is different from any existing solution in the market.

Give them reasons to invest in your mobile app, and this can only be done when they are convinced that your app would multiply their revenue goal.

Bring a flavorful taste of app branding

What brings your attention to a book gallery? A book cover or blank pages?

Of course, it is the book cover, that works as a branding platform for the app, and encourages you to pick the book. Your mobile app concept is also similar; by having an actual domain name, a landing page, and a logo showcase that you’re serious about your app.

I agree it would not get you the funding, but it will pave a way for the investors to take interest in your app, and further check more about it.

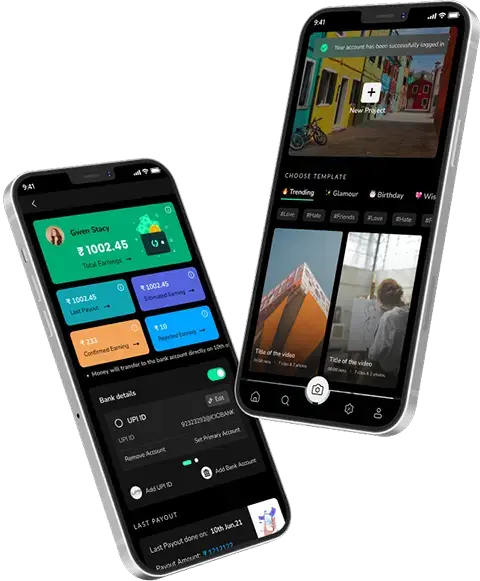

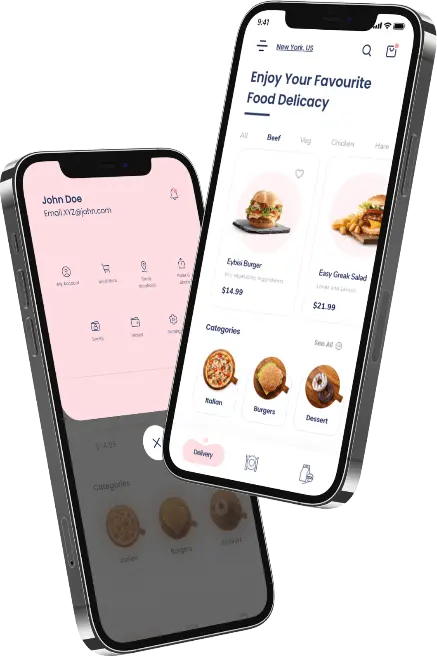

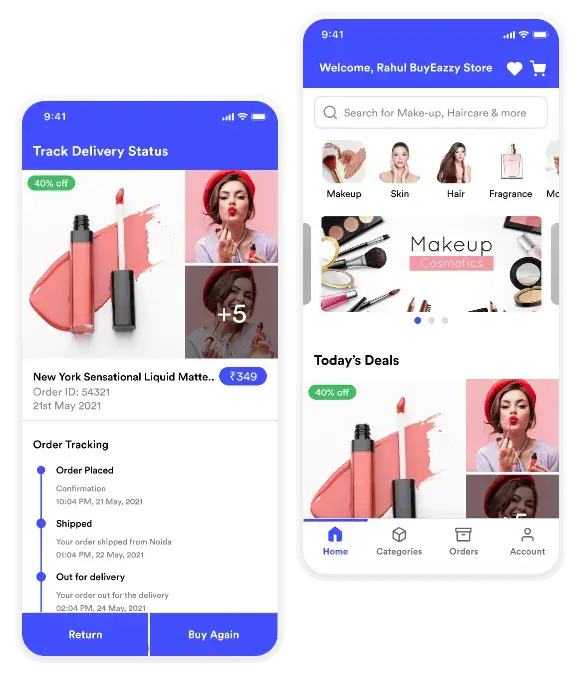

Create app demo or MVP

As branding carves a clear image of your concept to investors to visualize. Similarly, an app demo or MVP would clear the vision, and brings you in different image in front of your investor. With an MVP you prove to be serious enough for your concept and this ensures investors that you are ready to put your best foot forward to win the opportunity. Further, an MVP allows your investors to see and interact with your idea. Also, it will give help them gaining confidence over your concept, that you are really looking forward to bring your app to life.

Include plan for sales & marketing

Not a single product turns into a success without the sales and marketing intervention. And you need to plan, how these two factors are going to be a part of your app concept. Include these aspects into your pitch to convey your plan of successful sales and marketing, and how you are going to sail ahead with the existing competitors, so it can nail the deal for your concept, from every possible angle. Also, if possible invest some time in creating marketing calendar to share your planned steps for the further success.

Pro Tips

Grow stronger with every NO

It is very common for you to hear a NO, and it would not be one or two but can be multiple before that final YES. I know it sounds discouraging, but you need to understand the game behind it. And you should be positive enough to bring learning out of it. When you hear NO them introspect that why this happened, put yourself into investor’s shoe and experience where is it pinching.

Work on the pitch to make it sound better and more USEFUL for the investors. And then get ready. Get a strong hold onto your material back and forth, it should be on your lips which you can explain from the heart, not from the mind. Practice enough to anticipate questions you might be asked and this helps you prepare your pitch clearly.

Before convincing others, convince yourself

When you decide to move ahead with the app funding, the very first aspect that should be extremely clear with you is the concept of the app.

Yes, you might find it insane, as you know it well already, then why you are asked to know more about it?

Then you must know that the app concept should be re-understood from the perspective of the investor’s approach. To convince them you would need to work upon describing your app to someone and see how the concept can be perceived from the investors’ approach.

Concluding note

Don’t forget, startups come in many shapes and sizes, from fully VC funded to self-funded & bootstrapped. One thing that must be with you is the flexibility embrace any changes. Sometimes user testing throws up curve ball, resulting in drastic changes. You should be open to new ideas to make your product customer-centric from every possible angle.

With this hope that above mentioned tips will help you secure funding for your app startup, I bid adieu to you all.

Get in touch.

Write Us

sales@techugo.comOr fill this form